It sparked my interest as even Warren Buffet recommends diversified index funds:

"My money, I should add, is where my mouth is: What I advise here is essentially identical to certain instructions I’ve laid out in my will… My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers."

Warren Buffet

Page 20, 2013 Berkshire Annual Letter to Shareholders

Use $500K cash and borrow $500K @ 5% to invest $1m in ASX200/300 index fund and do nothing for 20 years and for first 10 years invest additional $5K/month.

- ETF: Betashares A200 0.07% pa - ASX200

- ETF: Vanguard VAS 0.14% pa - ASX300

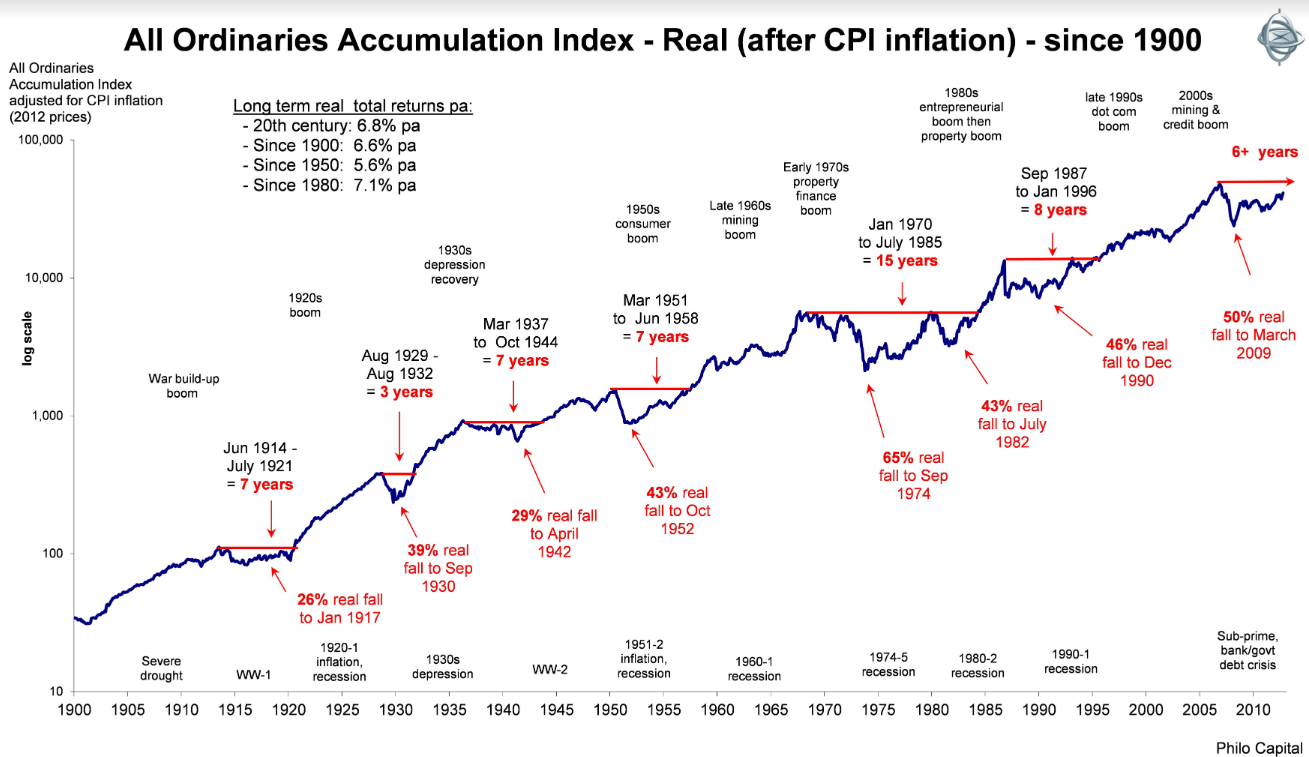

Why? Broadly the All Ordinaries has always gone up long term, this aligns with GDP/population growth:

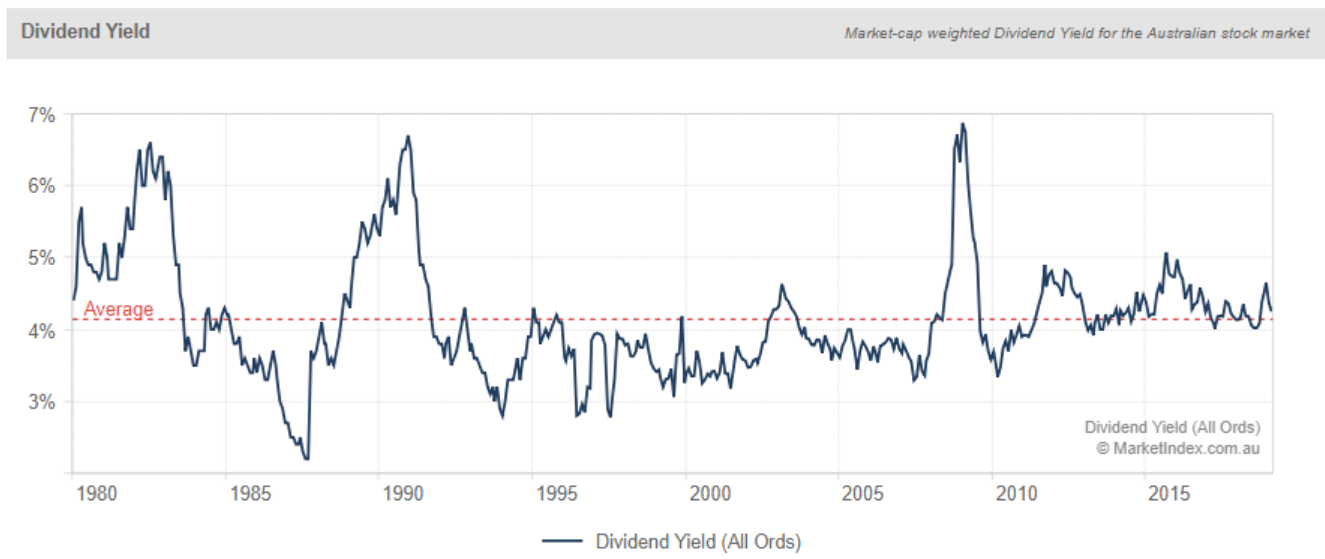

Long term All Ordinaries has good dividend yield, so even unemployed the dividends on $1m and could service 5% interest on $500K loan:

- Dividend on $1m estimated: $40,000

- Interest on $500K loan @ 5%: $25,000

I am considering doing this, yet my only question is whether to do it now or to sit on cash until there is a significant market correction:

- Current PE ratio: 17.18 - we are now in late cycle economy

- I would wait until All Ordinaries corrects to PE ratio of 13 or less

Here is model of expected growth with low compound growth of only 5%:

Here is model of expected growth of 10% (still lower than historical 13.9% average):

Here is another model of expected growth of 10% (still lower than historical 13.9% average):

- During year 1-10: start with $1m and contribute $5K/month. At 10% compound growth rate that will be $3,731,266 after 10 years

- During year 11-20: start with $3,731,266, then no additional contributions. At 10% compound growth rate that will be $10,100,692 after 10 years

I am not a financial adviser, nor do I claim to have a clue about finance. I am not affiliated with any ETFs and do not derive any benefit from this post. General educational information only, not financial or taxation advice, yada yada.

https://www.aussiefirebug.com/vanguard-diversified-index-etfs/

- 40% Oz shares (VAS 0.14% fee), 60% international (VGS 0.18% fee), DRP option available

- 40% Oz shares (VAS 0.14% fee), 60% international (VTS 0.03% fee + VEU 0.09% fee), DRP option only available for VAS

- 100% Oz shares (VAS 0.14% fee), Dividend focused, DRP option available

- Diversified ETFs (VDHG 0.27% fee), auto re balancing, DRP option available

No comments:

Post a Comment