- Change from internal combustion engine to electric

- Connectivity

- Autonomous driving

- Shared mobility

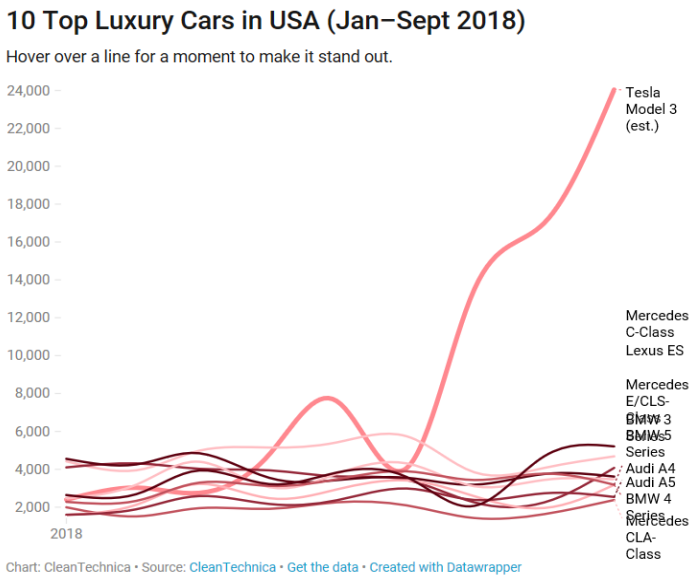

We are already seeing disruption in the industry. The Tesla Q3 2018 earnings call was the emperor has no clothes moment for the whole auto industry. Tesla is profitable, has serious volume and will continue to grow larger at massive rate and gain market share:

http://ir.tesla.com/events-and-presentationshttp://ir.tesla.com/news-releases/news-release-details/tesla-q3-2018-vehicle-production-and-deliveries

Forbes: In USA Tesla Just Outsold Mercedes-Benz, Audi, Acura, Infinity In America, About To Crush BMW, Lexus Q4:

"Tesla outsold Mercedes-Benz (66,542), Audi (59,478), Acura (41,830) and Infinity (33,079) in America with close to 70,000 vehicles sold, our current sales estimate indicates that Tesla is on track to surpass Lexus (78,622) and BMW (71,679) in the final quarter of this year.". "Tesla only has 3 models and outsold long-established premium competitors, each of which has multiple models and a vast network of dealerships".

Tesla is destroying the competition:

While the model 3 is completely dominating its class amongst mid-size luxury, let us not forget the Model S, which is by far the largest seller in the large luxury car market:

While the model 3 is completely dominating its class amongst mid-size luxury, let us not forget the Model S, which is by far the largest seller in the large luxury car market:

It will be interesting to see how the Tesla sales change in the coming months with regard to Europe and Asia sales. If sales follow same pattern as they have in the US then clear disruption is ahead for the legacy automakers.

It will be interesting to see how the Tesla sales change in the coming months with regard to Europe and Asia sales. If sales follow same pattern as they have in the US then clear disruption is ahead for the legacy automakers.

Tesla is destroying the competition:

German automakers have traditionally sourced parts from OEMs and have been slow to adapt all electric vehicles as they are trying to maintain high profit margins with internal combustion engine vehicles. They are desperate to slow down the transition to electric vehicles, they are actively lobbying against emission reductions.

Tesla is vertically integrated and has at least 4 year lead over other automakers in EVs::

The challenge for legacy car makers is that electric car adoption is now doubling year on year and consumers want affordable electric vehicles. Now both US and China are at over 3% with EV adoption. Here is EV growth for USA:

2016: 0.9%

2017: 1.2%

2018: 3.1%

The legacy car makers need to compete, they need to be vertically integrated and have cars that are designed from the ground up rather than using a shared platform strategy where they intend to to use the same platforms for their ICE cars, hybrids, and EVs, Legacy carmakers can not be competitive with EVs that have no design compromises. Yes, it saves legacy car companies on converting their production lines, saves by sharing parts too, and makes it easier to respond to unknown demand levels for EVs moving forward. But it also appears to guarantee close to no demand for these compromise vehicles going forward into a future with ever increasing EV demand and competition.

The European automakers are planning the following all electric vehicles:

- Jaguar I-Pace - 2018

- Audi e-Tron - 2019

- Mercedes EQC - 2020

- BMW iX3 - 2020

These are all mid sized SUVs and most news outlets have positioned the above as Tesla Killers competing with the Tesla Model X even though the Tesla Model X is a much larger SUV and was released three years ago in 2015. The real competitor will be the new Tesla Model Y a mid sized SUV based on Tesla Model 3 drivetrain/battery to be released in 2020, this will be a high volume SUV priced at much lower cost than the Tesla Model X.

Upcoming "Tesla Killers":

A few notes:

- These are medium sized SUVs significantly smaller than Tesla model X

- Larger/heavier Tesla X has smaller battery yet has longer range hence has more efficient drive train (even though technology was released in 2015) and Europeans will release 2019+ with subpar technology. See here for details.

- Tesla have significant cost advantages:

- Direct sales. Legacy car companies charge 15% more as dealers need to make margin.

- Vertically integrated, many components made in-house rather than sourced from OEMs. Massive investment in Gigafactory battery production.

- Why would anyone buy electric SUV that is 70%+ more expensive than ICE based vehicle when when it is built on shared platform that is mostly the same. This strategy appears to guarantee close to no demand for these electric vehicles. Here are some examples:

- Audi: Q5 (US$41K) vs e-Tron (US$75K in 2019)

- Mercedes: GLC (US$40K) vs ECQ (US$70K in 2020)

- Jaguar: F-Pace (US$42K) vs I-Pace (US$70K in 2018)

- Tesla: No legacy combustion model to protect, Model Y (US$46K in 2020)

If legacy car companies do not produce competitive electric alternatives to Tesla they will lose market share rapidly.

Disruption can come very quickly. Transition from horse-drawn carriages to cars came quickly. Please note this transition was far more complex than transition to electric cars. Here is photo of New York City 5th Avenue in 1900 showing street full of horse-drawn carriages:

Same street 13 years later, complete transition to cars:

No comments:

Post a Comment