- Live well, yet be frugal

- Avoid debt

- Save significant component of every dollar that you get and invest, aim for 50%+

- Put this money in low cost index fund like the Vanguard Total Stock Market Index Fund (VTSAX)

- Once your investment is 25x your annual needs retire early. Say you need $40K/year x 25 = $1m investment savings required

- Withdraw 4% annually

- Below assumes 8% annual investment return to reach 25x annual needs:

http://www.mrmoneymustache.com/2011/06/07/where-should-i-invest-my-short-term-stash/

http://www.mrmoneymustache.com/mmm-recommends/

https://www.abc.net.au/news/2018-02-14/why-i-decided-to-skip-home-ownership-to-retire-at-35/9378412

https://www.aussiefirebug.com/start-here/

https://jlcollinsnh.com/2013/05/02/stocks-part-xvii-what-if-you-cant-buy-vtsax-or-even-vanguard/

https://investor.vanguard.com/mutual-funds/profile/overview/VTSAX - Stocks

https://investor.vanguard.com/mutual-funds/profile/VBTLX - Bonds

https://investor.vanguard.com/mutual-funds/profile/VBINX - 60% Stocks / 40% Bonds

Recommended asset allocation determined by billionaire Ray Dalio.

30% Stocks, 7.5% Commodities, 7.5% Gold, 15% Intermediate Bonds, 40% Long Term Bonds

- Apparently it's time tested for the past 80 years:

- Just under 10% average annualised returns.

- Only four down/negative years- average loss of 1.9% in those 4 years

- Worst year was -3.93% in 2008 (when S&P 500 was down 37%)

- http://www.lazyportfolioetf.com/allocation/ray-dalio-all-weather/

FU Money:

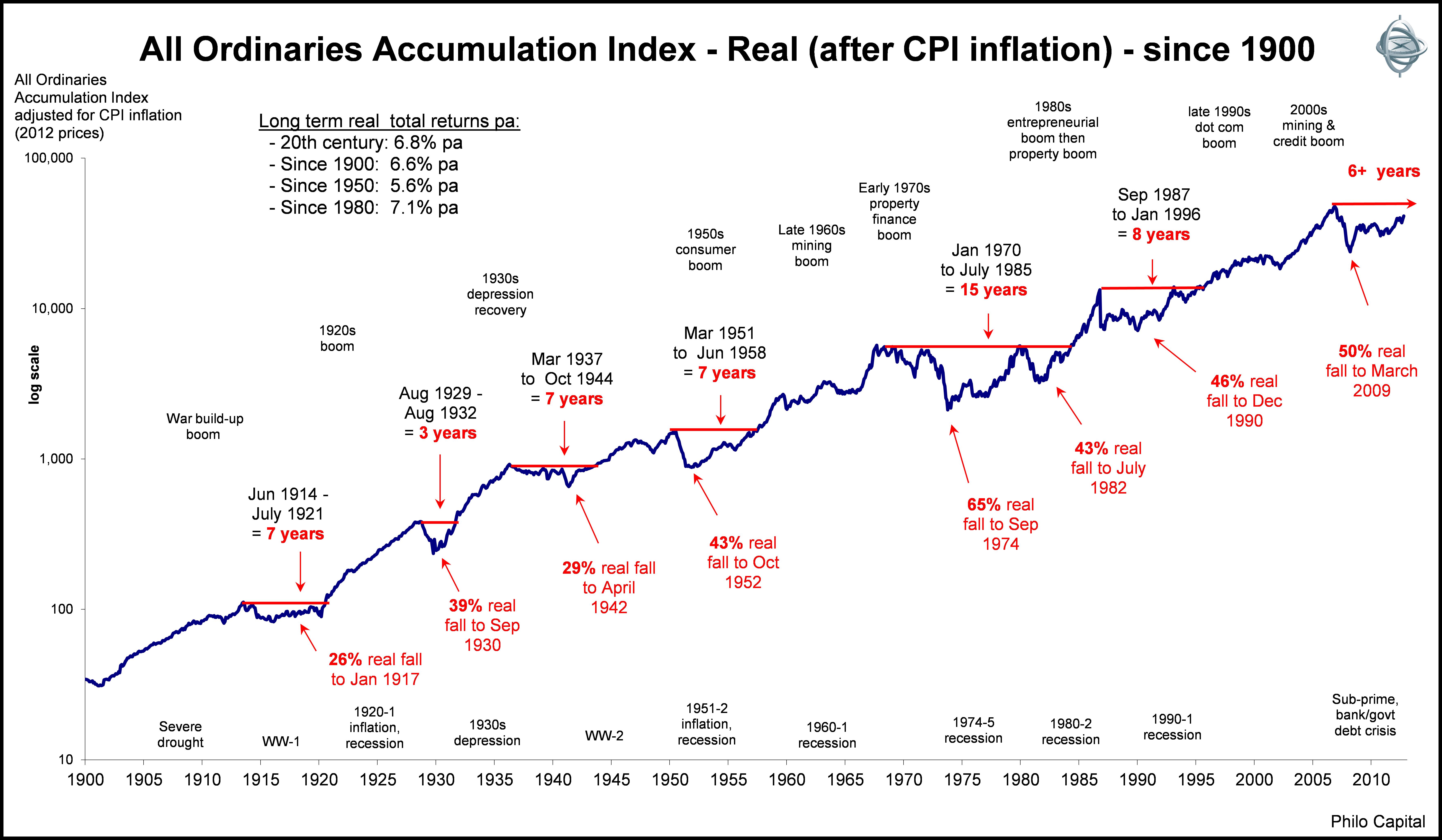

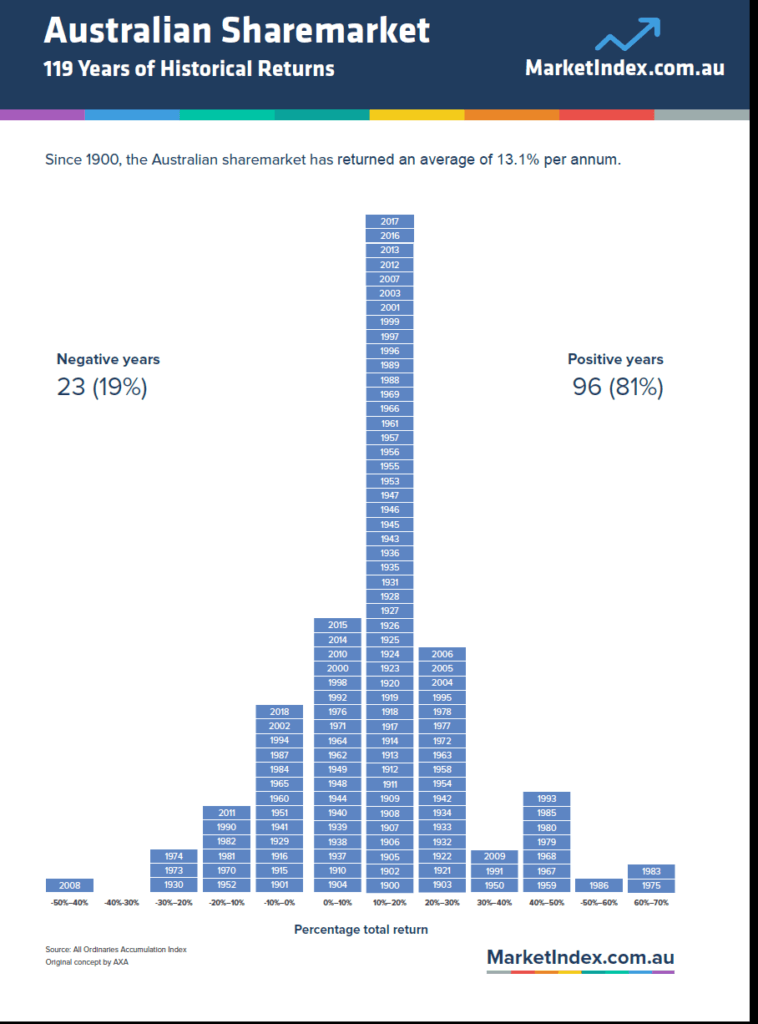

Yet remember turbulent times ahead:

Australian ETFs - VGS, VAS, VHY, VDHG:

Lazy Portfolios:

http://www.lazyportfolioetf.com/allocation/ray-dalio-all-weather/

http://www.lazyportfolioetf.com/allocation/simple-path-to-wealth/ JL Collins

http://www.lazyportfolioetf.com/allocation/stocks-bonds-60-40/

https://www.etfbloke.com/lazy-portfolio-australia/

- 33% invested in VAS (Australian Stocks)

- 33% invested in VGS (International Stocks)

- 33% invested in VGB (Bonds)

Lazy all weather aussie portfolio:

- 25% invested in VAS (Australian Stocks)

- 30% invested in VGS (International Stocks)

- 40% invested in VGB (Bonds)

- 5% invested in PMGOLD (Gold)

Retirement strategy - max out $25k/year on Super and dividend-paying, quality shares of ETFs:

Thornhill is an advocate for leveraging from day 1. In the beginning, leverage an amount you can easily pay off in one year, with an interest expense equal to the amount of dividends.

Even Warren Buffet recommends index funds:

"My money, I should add, is where my mouth is: What I advise here is essentially identical to certain instructions I’ve laid out in my will… My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers."

Update 21/5/2019 - New Documentary - Playing with Fire:

Update 21/12/2020 - FIRE is possible, yet have to be frugal:

No comments:

Post a Comment